Contents:

The PE transaction exposure what are the 4 primary forms of transactions from which can be seen as being expressed in years, in the sense that it shows the number of years of earnings which would be required to pay back the purchase price, ignoring inflation. So in general terms, the higher the PE, the more expensive the stock is. Get stock recommendations, portfolio guidance, and more from The Motley Fool's premium services. Volatility profiles based on trailing-three-year calculations of the standard deviation of service investment returns. Maintaining independence and editorial freedom is essential to our mission of empowering investor success.

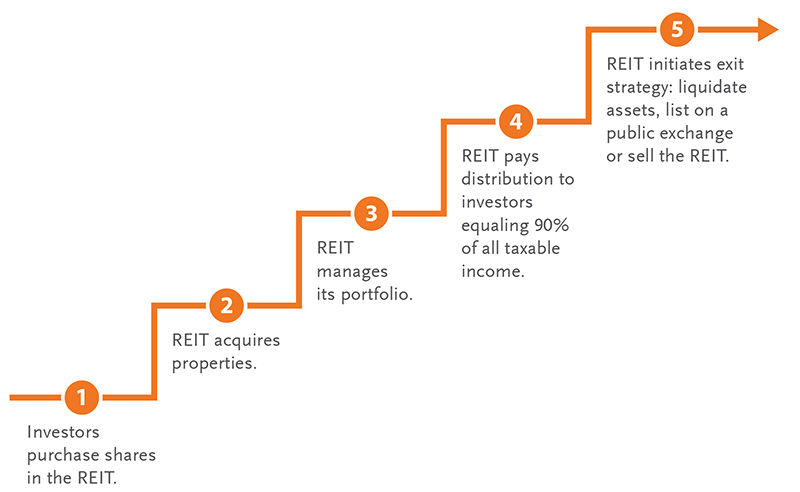

FT is not responsible for any use of content by you outside its scope as stated in the FT Terms & Conditions. Perhaps the most debated topic of the new normal, the concept of real estate stocks to sell finally achieved mass-scale credibility. It all comes down to fundamental realities and it's better to not o... Rocket Companies witnessed a jump in share price last session on above-average trading volume. The latest trend in earnings estimate revisions for the stock doesn't suggest further strength down...

- The Company's operating segments comprise the Hygiene, Health and Nutrition business.

- Since then, RKT shares have increased by 35.6% and is now trading at $9.49.

- Rocket Companies updated its first quarter 2023 earnings guidance on Tuesday, February, 28th.

- In my opinion, the housing boom should have sent this into the upper $20s.

- And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data.

An https://1investing.in/ with a larger percentage of Zacks Rank #1's and #2's will have a better average Zacks Rank than one with a larger percentage of Zacks Rank #4's and #5's. He has ‘deep’ knowledge of the consumer but lacks restaurant experience. To opt-in for investor email alerts, please enter your email address in the field below and select at least one alert option. After submitting your request, you will receive an activation email to the requested email address. You must click the activation link in order to complete your subscription. Sign-up to receive the latest news and ratings for Reckitt Benckiser Group and its competitors with MarketBeat's FREE daily newsletter.

Q1 2023 Reckitt Benckiser Group PLC Trading Statement Release

These small companies have carved out economic moats, and their stocks are undervalued. There may be delays, omissions, or inaccuracies in the Information. Zacks Earnings ESP looks to find companies that have recently seen positive earnings estimate revision activity.

These products and services are usually sold through license agreements or subscriptions. Our investment management business generates asset-based fees, which are calculated as a percentage of assets under management. We also sell both admissions and sponsorship packages for our investment conferences and advertising on our websites and newsletters. High-growth stocks tend to represent the technology, healthcare, and communications sectors.

Member Sign In

The company has rapidly gained market share in recent years and is now the largest mortgage originator in the U.S. as well as the servicer for more than 2 million loans. Rocket Companies, Inc. engages in the tech-driven real estate, mortgage, and e-Commerce businesses in the United States and Canada. 6 analysts have issued 12-month target prices for Reckitt Benckiser Group's shares. Their RKT share price forecasts range from GBX 6,750 to GBX 8,200. On average, they expect the company's share price to reach GBX 7,320 in the next twelve months.

The company issued 150,000,000 shares at a price of $20.00-$22.00 per share. Rocket Companies has a short interest ratio ("days to cover") of 11.8, which indicates bearish sentiment. According to analysts' consensus price target of $7.67, Rocket Companies has a forecasted downside of 19.2% from its current price of $9.49.

About Rocket Companies (NYSE:RKT) Stock

This score is calculated as an average of sentiment of articles about the company over the last seven days and ranges from 2 to -2 . This is a higher news sentiment than the 0.35 average news sentiment score of Business Services companies. Though the housing sector represented one of the most remarkable developments of the post-coronavirus new normal, the subsequent paradigm shift necessitates a discussion about real estate stocks to se... With major economic weakness possibly lurking around the corner, investors should consider targeting stocks to sell. Specifically, market participants should note securities that feature rising short ...

We provide a platform for our authors to report on investments fairly, accurately, and from the investor’s point of view. We also respect individual opinions––they represent the unvarnished thinking of our people and exacting analysis of our research processes. Our authors can publish views that we may or may not agree with, but they show their work, distinguish facts from opinions, and make sure their analysis is clear and in no way misleading or deceptive.

Other then thay building and selling homes.Noticed the calmness after the interest rate hikes, lots and homes are not selling the way theh used to. I do expect the real estate market to fall Hopefully it wont be too much but the more they raise the interest rates the scarier the narket looks Ill get back into the stock market but not yet. Intraday Data provided by FACTSET and subject to terms of use.

Price and EPS Surprise Chart

Rocket Companies does not have a long track record of dividend growth. Please log in to your account or sign up in order to add this asset to your watchlist. Upgrade to MarketBeat All Access to add more stocks to your watchlist.

It is challenging to find stocks that pay enough money to retire on. For example, even a 3.3% dividend—generous by today’s standards—isn’t enough to turn a... Dividend yield shows how much a company pays its shareholders in dividends annually per dollar invested. It reflects how much an investor will earn aside from any capital gains in the stock. Data are provided 'as is' for informational purposes only and are not intended for trading purposes. Data may be intentionally delayed pursuant to supplier requirements.

Rocket Companies shares split on Thursday, August 28th 2014. The newly minted shares were payable to shareholders after the closing bell on Wednesday, August 27th 2014. An investor that had 100 shares of stock prior to the split would have 200 shares after the split. After March kicked off with a session that indicated the worst for stocks may be over , Tuesday saw the indices sell-off towards the close. Tech stocks jump after hours Yesterday's panic turned to exuberance Markets remain unstable Dow, S&P, NASDAQ, and Russell 2000 futures as well as European advanced as corporate...

The monthly returns are then compounded to arrive at the annual return. Only Zacks Rank stocks included in Zacks hypothetical portfolios at the beginning of each month are included in the return calculations. Zacks Ranks stocks can, and often do, change throughout the month.

Reckitt Benckiser Group pays a meaningful dividend of 2.97%, higher than the bottom 25% of all stocks that pay dividends. One share of RKT stock can currently be purchased for approximately $9.49. Rocket Companies updated its first quarter 2023 earnings guidance on Tuesday, February, 28th. The company issued revenue guidance of $700.00 million-$850.00 million, compared to the consensus revenue estimate of $805.81 million. The company is scheduled to release its next quarterly earnings announcement on Tuesday, May 9th 2023. 94.01% of the stock of Rocket Companies is held by insiders.

End of confusion: Quicken Loans will officially change name to ... - WDIV ClickOnDetroit

End of confusion: Quicken Loans will officially change name to ....

Posted: Wed, 12 May 2021 07:00:00 GMT [source]

It allows the user to better focus on the stocks that are the best fit for his or her personal trading style. Sign Up NowGet this delivered to your inbox, and more info about our products and services. 59.52% of the stock of Reckitt Benckiser Group is held by institutions. High institutional ownership can be a signal of strong market trust in this company.

This suggests a possible upside of 17.5% from the stock's current price. View analysts price targets for RKT or view top-rated stocks among Wall Street analysts. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Since 1988 it has more than doubled the S&P 500 with an average gain of +24.52% per year.